Order Creation

Generate trade orders through rebalancing, bulk orders, or manual entry.

Managing trading workflows presents challenges across portfolio alignment, compliance, and efficiency. Regulatory compliance across jurisdictions demands automated validation systems to ensure adherence to both internal policies and external regulations.

Bulk order management and workflow customization add further complexity. Large-scale rebalancing or liquidity needs can overwhelm traditional systems, while institutions often require tailored approval workflows to meet internal oversight requirements. Without such flexibility, delays and errors can compromise execution quality.

Fragmented systems and limited trade transparency amplify these challenges. Disconnects between trading, compliance, and reporting processes slow decision-making and create risks. Additionally, gaps in visibility throughout the trade lifecycle can lead to operational uncertainties, underscoring the need for a fully integrated trading approach.

Simplified Portfolio Alignment: Automate portfolio realignment with predefined rebalancing models, ensuring fast, error-free execution.

Mandate and Regulatory Compliance: Real-time checks for portfolio mandate adherence and regulatory requirements safeguard trades at every step.

Streamlined Bulk Ordering: Manage large-scale and individual orders effortlessly, saving time and increasing operational efficiency.

Customized Approval Workflows: Configure flexible approval processes tailored to your institution's specific policies.

Integrated Order Lifecycle Management: Built-in compliance checks ensure alignment with regulatory standards.

Dynamic Reporting Capabilities: Handle everything from creation to settlement within one platform for seamless operations.

Real-Time Trade Transparency: Provide clients and internal teams with execution feedback, ensuring complete visibility into the trade lifecycle.

Scalable Multi-Asset Trading: Trade across equities, funds, fixed income and derivatives investments with ease.

Generate trade orders through rebalancing, bulk orders, or manual entry.

Automatically validate trades against both regulatory rules and portfolio-specific mandates.

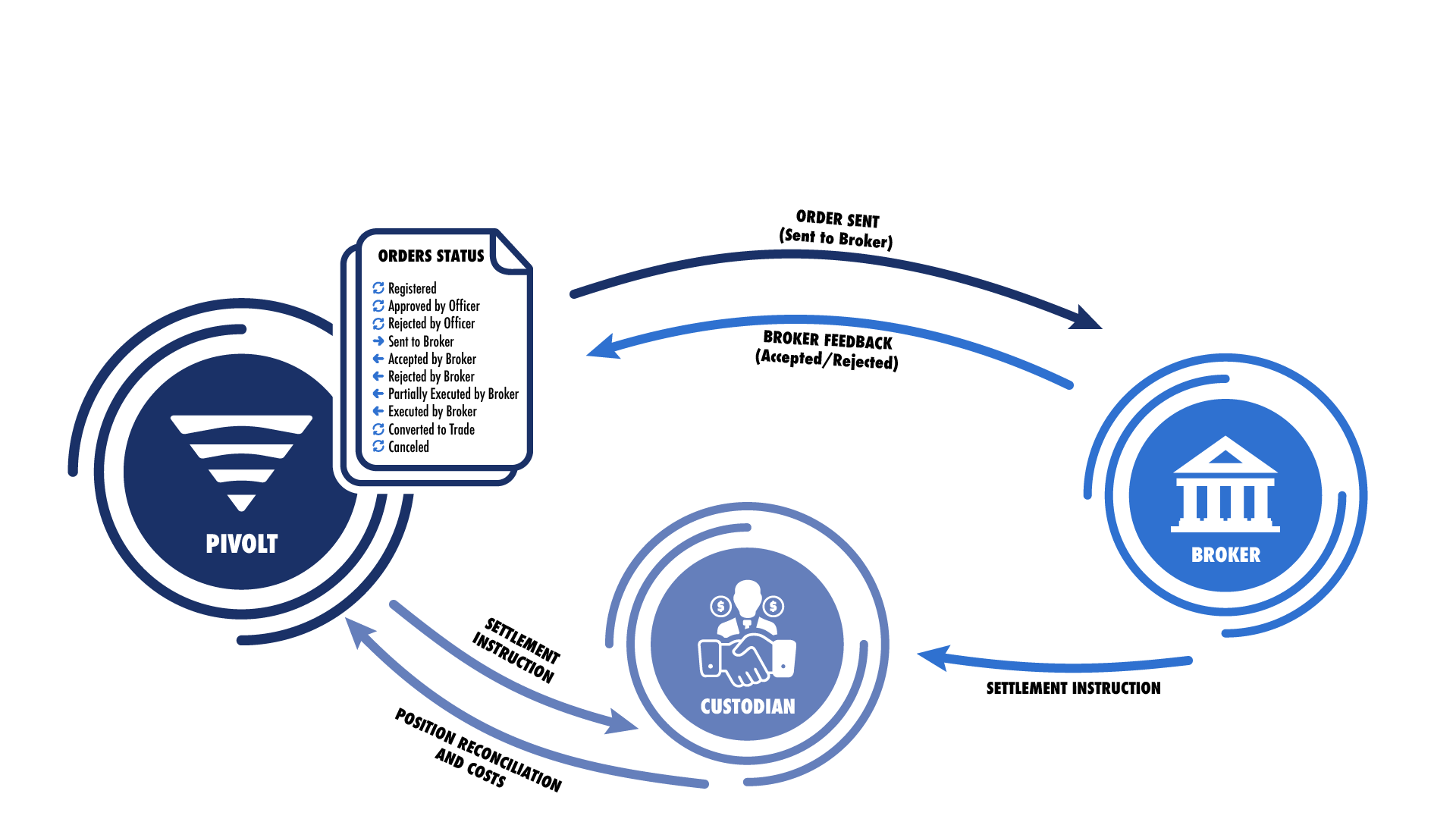

Connect with brokers via FIX protocol for real-time order routing, execution, and tracking across multiple asset classes.

Manage settlement instructions tailored to custodians, receive execution feedback, and track settlement status for a full trade lifecycle overview.

Generate post-trade compliance reports and exception alerts to ensure adherence to regulatory standards and internal mandates.