For decades, benchmarks have served as the industry standard for evaluating investment performance. Whether comparing to the S&P 500, MSCI World, or a 60/40 blended index, advisors and clients alike have relied on these external references to measure success. But are these benchmarks still serving their purpose—or have they become relics of a past investment paradigm?

The next generation of investors is more diverse in objectives, more fluid in time horizons, and more nuanced in their expectations. Comparing a goal-driven, impact-focused portfolio to a market-cap weighted index not only misleads—it distorts. As portfolios evolve beyond traditional constructs, so must the way we define success.

In this article, we investigate how the standard benchmarking model is falling short in representing today’s investor needs. We also explore emerging alternatives that better reflect complexity, personalization, and purpose within wealth management.

From short-term liquidity goals to legacy planning, from ESG-driven mandates to capital preservation—each objective demands a frame of reference that resonates with intent. Traditional benchmarks, by contrast, assume a uniform path to value creation.

If we truly want to align portfolios with people, we must challenge the relevance of standardized yardsticks. Let’s reframe what performance really means.

Traditional benchmarks were designed for institutional comparability—not individual relevance. They represent an average market construct, not a specific investor’s purpose or time horizon. Comparing a conservative portfolio designed to preserve capital with an aggressive equity index is not only unfair—it’s misleading.

One-size-fits-all benchmarks ignore critical investor variables: tax position, risk tolerance, liquidity needs, and personal objectives. A 70-year-old retiree seeking steady income should not be measured against the same yardstick as a 30-year-old entrepreneur focused on long-term growth. Yet, the same benchmarks are routinely applied to both.

This misalignment leads to dissonance in performance reviews and strategic planning. It penalizes advisors who construct thoughtful portfolios aligned with client goals, simply because they diverge from aggressive index returns. Worse, it encourages style drift—adjusting strategies not for the client’s benefit, but for optics.

Instead of empowering investors with insight, standard benchmarks often undermine confidence and create friction. Advisors are left justifying why a well-designed, risk-aware portfolio “underperformed” relative to a benchmark it was never meant to track. This problem is systemic, not anecdotal.

What’s needed is a more elastic framework for comparison—one that honors the unique structure, priorities, and purpose of each portfolio. The benchmark should serve the investor, not the other way around.

Benchmarks don’t just influence measurement—they shape behavior. Advisors, under pressure to demonstrate relative outperformance, may tilt portfolios toward more volatile assets, even when that deviates from the client’s risk profile. The need to “beat the index” can introduce hidden leverage, unintended exposures, and emotional trading.

This is particularly evident in periods of market exuberance. When benchmark returns soar, clients naturally question why their more cautious portfolios haven’t kept up. Without a customized frame of reference, advisors are cornered into defending prudence as if it were failure.

Benchmark obsession also distorts communication. Conversations become narrowly focused on alpha generation, rather than alignment with long-term life goals. Performance becomes divorced from purpose. Over time, this erodes trust and weakens client engagement.

The irony is that advisors may achieve better long-term outcomes by deviating from benchmarks—but doing so exposes them to critique and second-guessing. In such cases, the benchmark acts less like a tool and more like a trap.

To evolve, the industry must recognize that good strategy isn’t always benchmark-aligned. It’s client-aligned. And that distinction changes everything about how portfolios should be built—and measured.

An emerging alternative to traditional benchmarks is the use of goal-based metrics. Instead of measuring success against an external market index, investors are evaluated based on progress toward personal objectives—retirement readiness, philanthropic funding, liquidity events, or intergenerational transfers.

Goal-based frameworks recognize that success is contextual. A portfolio that meets a family’s legacy target or sustains income for a 30-year retirement should be celebrated—even if it trails a global index. These metrics shift the narrative from relative return to real-world relevance.

Moreover, they foster better engagement. Investors understand goals. They relate to timelines and milestones, not Sharpe ratios. By framing success in personal terms, advisors can build stronger relationships, reduce emotional volatility, and offer clarity amid market noise.

Importantly, goal-based metrics also support segmented benchmarking—different targets for different “buckets” of capital. Growth, income, liquidity, and ESG may each have separate evaluation paths. This layered approach offers nuance, without sacrificing discipline.

The future of performance evaluation lies not in removing benchmarks, but in replacing outdated ones with frameworks that reflect human intention. Goal-based metrics offer that bridge.

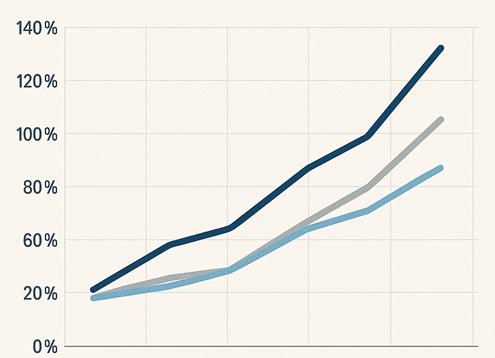

Technology has made it possible to build highly customized benchmarks tailored to an investor’s actual strategy. These dynamic references may include inflation-adjusted returns, risk-weighted asset mixes, ESG overlays, or client-specific constraints. The result is a benchmark that mirrors the investor’s reality—not an arbitrary market standard.

For example, a portfolio designed to deliver 4% net income per year can be benchmarked against a tailored income stream—not a growth index. Similarly, a philanthropic fund with a 15-year spending horizon might compare performance to a glide path that accounts for mission fulfillment, not just price return.

Custom benchmarks also improve governance. Trustees, family councils, and investment committees benefit from clarity and consistency when measurement tools align with the actual mandate. Misinterpretation is reduced, and decision-making becomes more rational.

Critically, these tools must be transparent and explainable. A benchmark loses its value if it becomes another black box. The best systems empower users to define, adjust, and communicate benchmarks that evolve with the portfolio’s role and context.

We’re no longer limited by static indices. Advisors now have the infrastructure to make performance measurement not only fairer—but smarter.

Traditional benchmarks once provided structure in an otherwise opaque investment world. But for many of today’s investors, they’ve become blunt tools—misrepresenting priorities, distorting incentives, and complicating conversations. It’s time for a new era of performance measurement, one rooted in personalization and purpose.

This shift isn’t just a philosophical one—it’s operational. Firms that embrace more flexible, contextual metrics will create better alignment between advisors and clients, reduce behavioral friction, and build narratives that reflect real-world relevance. The benchmark should illuminate, not obscure.

More importantly, clients themselves are asking for change. They don’t want to be told how their portfolio compares to an abstract market. They want to know: Am I on track for what matters to me? Did my plan absorb the shocks and stay resilient? Are my intentions reflected in the strategy?

Technology now enables us to respond. We can model, adapt, and report in ways that acknowledge complexity without overwhelming the investor. The opportunity is not just to measure better—but to communicate better. And in wealth management, that is everything.

Pivolt allows wealth firms to build custom benchmarks, goal-based dashboards, and narrative-driven reporting—bringing clarity and precision to client communication. When measurement evolves, trust follows. That’s the real benchmark of progress.